How I Started Late and Finished Rich: My Journey to Financial Freedom and You Can Too!

As I reflect on my own journey toward financial independence, I often find myself drawn to the philosophy behind “Start Late, Finish Rich.” This powerful mindset challenges the conventional belief that financial success is reserved for those who begin their investment journeys early in life. Instead, it empowers those of us who may feel like we’ve missed the boat, suggesting that it’s never too late to take control of our financial destinies. In this article, I will explore the principles and strategies that can help anyone, regardless of age or starting point, cultivate wealth and achieve their dreams. Join me as I delve into the transformative ideas that can turn late bloomers into financial success stories, proving that the road to riches can begin at any stage of life.

I Explored The Benefits of a Plant-Based Diet and Share My Insights Below

Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age

Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age 1St edition by Bach, David (2005) Hardcover

1. Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age

As I delve into “Start Late, Finish Rich A No-Fail Plan for Achieving Financial Freedom at Any Age,” I can’t help but feel a sense of excitement and optimism. This book is a beacon of hope for anyone who feels they may have missed the financial boat. The title alone resonates with me, as it speaks to the universal truth that it’s never too late to take control of your financial destiny. Whether you are in your 30s, 40s, or even beyond, this book emphasizes that achieving financial freedom is not just a dream but a realistic goal.

One of the most compelling aspects of this book is its focus on actionable strategies. The author does not merely provide theory; instead, they offer a practical roadmap that anyone can follow. The strategies are straightforward and designed to be implemented regardless of your current financial situation. This hands-on approach is incredibly empowering. I appreciate that the book recognizes the unique challenges faced by late starters and provides tailored solutions to help overcome these obstacles. The idea of achieving financial independence at any age is liberating, and I can see how it could motivate many individuals to take the first step toward a brighter financial future.

Moreover, the book addresses the emotional aspects of financial planning, which I find particularly noteworthy. It’s not just about numbers and investments; it’s about mindset and motivation. The author provides encouragement and real-life examples of people who have turned their financial situations around, which instills a sense of possibility. I feel that this emotional connection is crucial for readers who may be feeling discouraged about their financial prospects. By focusing on both the practical and emotional sides of financial freedom, the book equips readers with the tools they need to succeed.

The layout and structure of the book also deserve mention. It is organized in a way that makes it easy to digest. Each chapter builds on the previous one, guiding readers through a logical progression of ideas. I appreciate how the author breaks down complex financial concepts into easy-to-understand language, making it accessible for everyone. This user-friendly approach makes it an excellent choice for anyone, regardless of their prior knowledge of finance.

In my opinion, if you’re someone who has ever felt overwhelmed by the idea of financial planning or if you’ve been putting off taking control of your finances because you think it’s too late, this book is a must-read. It provides clarity, direction, and most importantly, hope. I can see how it could be the catalyst for many people to take charge of their financial futures and create the life they’ve always desired.

To give you a clearer picture of what “Start Late, Finish Rich” offers, I’ve compiled a table below summarizing some key features and benefits

Feature Benefit Actionable Strategies Provides practical steps that can be implemented immediately. Emotional Support Encourages a positive mindset and resilience against financial setbacks. User-Friendly Language Makes complex financial concepts accessible to all readers. Real-Life Examples Inspires readers with stories of individuals who achieved financial success. Structured Approach Guides readers through a logical progression, making the content easy to follow.

“Start Late, Finish Rich” is not just a book; it’s an invitation to reclaim your financial life, no matter when you start. I genuinely believe that anyone who reads this book will find valuable insights and actionable steps that can lead to significant changes in their financial well-being. If you’re on the fence about purchasing it, I encourage you to take the leap. Investing in this book could be one of the best decisions you make for your future.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

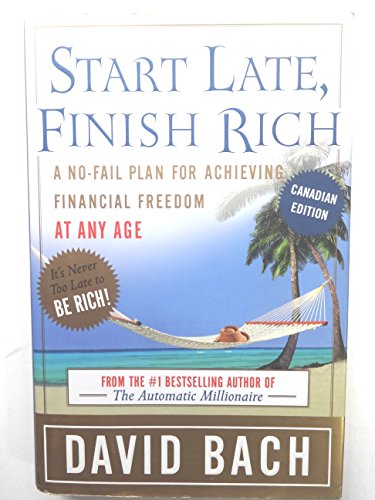

2. Start Late, Finish Rich, Canadian Edition

As I delve into the pages of “Start Late, Finish Rich, Canadian Edition,” I can’t help but feel a sense of excitement about the transformative journey that this book offers. For anyone who has ever felt that they are starting their financial journey later in life, this edition is a beacon of hope and practical guidance. It caters specifically to the Canadian audience, understanding our unique financial landscape, tax structures, and investment opportunities. This tailored approach makes the insights and strategies presented in the book even more relevant and applicable to me as a Canadian reader.

The book emphasizes the notion that it’s never too late to secure a prosperous financial future. The title itself resonates with so many of us who may have delayed our financial planning for various reasons. Whether it’s due to life circumstances, career changes, or simply the overwhelming nature of financial literacy, this book reassures me that I can still achieve my financial goals, no matter when I begin. With a plethora of real-life examples and relatable anecdotes, the author effectively inspires confidence in readers like me, demonstrating that financial success is attainable with the right mindset and strategies.

One of the standout features of this edition is its practical approach to wealth-building. The author breaks down complex financial concepts into easily digestible pieces, making it accessible for individuals at any stage of their financial journey. I appreciate how the book provides actionable steps, from budgeting and saving to investing and retirement planning, all tailored to the Canadian context. This is crucial, as navigating the Canadian financial system can sometimes feel daunting, but this book demystifies the process, empowering me to take control of my financial destiny.

Moreover, the motivational tone throughout the book encourages me to take immediate action. Each chapter builds on the last, reinforcing the idea that consistent, small steps can lead to substantial financial changes over time. It’s a refreshing perspective that resonates with me, especially when I consider the common pitfalls of procrastination and inaction. The author’s genuine belief in the reader’s potential is evident, and it inspires me to adopt a proactive approach to my finances.

In addition to the practical advice, “Start Late, Finish Rich” also addresses the emotional aspects of financial planning. The book recognizes that money is not just about numbers; it’s about the life I want to create for myself and my loved ones. This holistic view of wealth resonates deeply with me, as it encourages a balance between financial goals and personal fulfillment. The author emphasizes that financial success should align with my values and aspirations, which is a refreshing perspective often overlooked in traditional financial literature.

I wholeheartedly recommend “Start Late, Finish Rich, Canadian Edition” to anyone looking to take control of their financial future, regardless of when they start. The book is not just a guide; it’s a companion for my financial journey, providing me with the tools, motivation, and insights I need to succeed. If you’re feeling stuck or overwhelmed by your financial situation, this book could be the catalyst for change that you’ve been seeking. Remember, it’s never too late to start taking charge of your financial life—let this book be your guide.

Feature Description Canadian Focus Tailored financial strategies and insights specific to the Canadian financial landscape. Actionable Steps Clear, practical advice for budgeting, saving, investing, and retirement planning. Motivational Tone Encourages readers to take immediate action and adopt a proactive financial mindset. Holistic Approach Addresses the emotional aspects of money, aligning financial goals with personal values and aspirations.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

3. Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age 1St edition by Bach, David (2005) Hardcover

As someone who is deeply interested in personal finance and the principles of wealth building, I can’t help but feel excited about David Bach’s book, “Start Late, Finish Rich A No-Fail Plan for Achieving Financial Freedom at Any Age.” This book is a beacon of hope for anyone who believes it’s too late to secure their financial future. Whether you’re in your 30s, 40s, or even 50s, this book provides practical strategies that can help you achieve financial independence.

What I find particularly compelling about this book is Bach’s straightforward approach. He lays out a no-fail plan that demystifies the often intimidating world of personal finance. The strategies he discusses are not just theoretical; they are actionable and designed for real people living in the real world. The focus is on empowerment, showing readers that financial freedom is achievable regardless of age or current financial situation. This perspective is refreshing and incredibly motivating, particularly for those who may feel overwhelmed by their circumstances.

One of the key features of “Start Late, Finish Rich” is its emphasis on small, consistent actions that lead to significant results over time. I appreciate how Bach breaks down complex financial concepts into digestible pieces, making it easier for readers like me to understand and implement them. He teaches the importance of setting clear financial goals and developing a plan to reach them, which is something that I believe everyone can benefit from, regardless of their current financial knowledge.

Another standout aspect of this book is its focus on mindset. Bach emphasizes the importance of adopting a rich mindset—believing in my ability to achieve financial freedom. This psychological shift can be transformative, and I feel inspired by Bach’s encouragement to view money as a tool that can work for me rather than something that controls me. He provides practical exercises to help develop this mindset, which I find particularly valuable.

The book also offers a wealth of practical tips on saving, investing, and creating multiple streams of income. As someone who has always been interested in diversifying my income sources, I appreciate Bach’s insights on how to do this effectively. He discusses real estate investments, retirement accounts, and even starting side businesses, which are all avenues I can explore to secure my financial future.

Additionally, Bach’s writing style is engaging and relatable. He shares personal anecdotes and stories from others who have successfully implemented his strategies, which makes the content feel accessible and achievable. This relatable storytelling helps to solidify the book’s principles and makes me feel like I am not alone on this journey toward financial independence.

“Start Late, Finish Rich” is not just a book; it’s a comprehensive guide that can truly change the way I think about my finances. For anyone who feels that they’ve missed the boat on financial success, this book serves as a powerful reminder that it’s never too late to take control of one’s financial destiny. I genuinely believe that investing in this book could be one of the best decisions I make in my journey toward financial freedom. If you’re ready to transform your financial future, I highly recommend picking up a copy of “Start Late, Finish Rich.” You won’t regret it!

Feature Description No-Fail Plan A straightforward, actionable strategy for achieving financial independence. Mindset Shift Encourages adopting a rich mindset to empower financial growth. Practical Tips Includes insights on saving, investing, and creating multiple income streams. Relatable Stories Features anecdotes from people who successfully implemented the strategies. Accessible Language Breaks down complex financial concepts into understandable terms.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

4. Start Over, Finish Rich: 10 Steps to Get You Back on Track in 2010

As I delve into “Start Over, Finish Rich 10 Steps to Get You Back on Track in 2010,” I find myself drawn to the powerful message it conveys about personal finance and self-improvement. This book is not just a guide; it’s a roadmap for anyone looking to rejuvenate their financial life and regain control over their destiny. The year 2010 represents a pivotal time for many, and the principles laid out in this book are just as relevant today as they were when it was published. It speaks to individuals who may have faced setbacks—whether due to economic downturns, personal challenges, or simply a lack of direction—and encourages them to rise above and forge a path toward financial freedom.

One of the standout features of this book is its structured approach. The ten steps presented are not merely theoretical; they are actionable strategies that anyone can implement. Each step serves as a building block, allowing readers to progressively work towards their financial goals. I appreciate how the author breaks down complex concepts into digestible pieces, making it easier for me to understand and apply the advice. This kind of clarity is crucial for individuals who may feel overwhelmed by their current financial situations.

Moreover, the motivational tone of the book resonates deeply with me. It’s not just about numbers; it’s about changing one’s mindset. The encouragement to adopt a richer, more fulfilling outlook on life is an invaluable takeaway. I can envision how this shift in perspective could help individuals reclaim their confidence, which is often lost in difficult times. The book emphasizes that it’s never too late to start over, which is a powerful affirmation for anyone hesitant to take the first step toward financial recovery.

In addition to the actionable steps and motivational guidance, the book also emphasizes the importance of setting clear financial goals. It encourages readers to visualize their desired outcomes and create a roadmap to achieve them. I find this aspect particularly appealing, as it aligns with the idea that success is not just about hard work but also about having a clear vision. This clarity can empower individuals to stay focused and motivated on their journey to financial stability.

For those who are skeptical about investing their time and resources into a self-help book, I urge you to consider the potential benefits. The knowledge and strategies contained within “Start Over, Finish Rich” could serve as a catalyst for transformation in your financial life. Imagine having the tools to not only overcome your current challenges but also to build a prosperous future. It’s an opportunity that is too good to pass up.

Feature Description 10 Actionable Steps A structured approach to revamp your financial life. Motivational Guidance Encourages a positive mindset and personal empowerment. Goal Setting Helps visualize and create a roadmap for financial success. Clarity and Simplicity Complex concepts are broken down into easily understandable strategies.

“Start Over, Finish Rich 10 Steps to Get You Back on Track in 2010” is more than just a book; it’s a lifeline for those looking to reclaim control over their financial future. I genuinely believe that the insights and strategies it offers can lead to profound changes in one’s life. If you’re ready to take charge of your financial destiny and embrace a richer, more fulfilling life, then this book is a worthwhile investment. Don’t hesitate—grab your copy today and take the first step toward a brighter tomorrow!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

Why “Start Late, Finish Rich” Can Help Me Achieve Financial Freedom

As someone who has often felt overwhelmed by financial planning and investment strategies, “Start Late, Finish Rich” has been a game-changer for me. The book reassures me that it’s never too late to take control of my financial future. It emphasizes the importance of starting wherever I am, regardless of age or current financial situation. This perspective has motivated me to take those first crucial steps toward building wealth.

The practical strategies outlined in the book have empowered me to develop a personalized financial plan. I’ve learned how to set realistic goals and create a budget that aligns with my lifestyle and aspirations. The author’s no-nonsense approach demystifies complex financial concepts, making them accessible and actionable. I now feel equipped to make informed decisions about saving, investing, and even creating multiple income streams.

Moreover, the inspiring stories of individuals who turned their financial lives around resonate deeply with me. They remind me that success is not solely reserved for those who start early or have extensive knowledge. This book has instilled a sense of hope and possibility within me, proving that with the right mindset and tools, I can still finish rich, no matter when I start.

Buying Guide for ‘Start Late, Finish Rich’

Understanding the Book

When I first picked up ‘Start Late, Finish Rich’ by David Bach, I was intrigued by the promise of achieving financial success regardless of when I began my journey. The book emphasizes that it’s never too late to take control of my financial future. Bach’s approach resonated with me, as he provides practical strategies and a positive mindset towards wealth-building.

Identifying My Financial Goals

Before diving into the book, I took the time to reflect on my own financial goals. Whether I wanted to save for retirement, pay off debt, or invest in a home, having clear objectives helped me relate to Bach’s advice. I found that understanding my personal aspirations was crucial to applying the book’s principles effectively.

Assessing My Current Financial Situation

I realized that I needed to assess my current financial situation before implementing any strategies. This meant reviewing my income, expenses, savings, and debts. By having a clear picture of where I stood financially, I was better prepared to follow the actionable steps outlined in the book.

Applying the Strategies

As I began to read, I discovered numerous strategies that I could apply to my life. Bach stresses the importance of automating savings, which I found incredibly helpful. I set up automatic transfers to my savings account, making it easier to save without overthinking. The book also encouraged me to focus on small, consistent actions rather than drastic changes.

Building a Support System

One aspect that stood out to me was the importance of surrounding myself with a supportive community. I reached out to friends and family who shared similar financial goals. Sharing my journey and hearing their experiences motivated me to stay committed to the principles in the book.

Staying Committed and Tracking Progress

To truly benefit from ‘Start Late, Finish Rich,’ I learned the significance of commitment and tracking my progress. I started maintaining a financial journal where I documented my goals, milestones, and setbacks. This practice kept me accountable and allowed me to celebrate my achievements, no matter how small.

Reflecting and Adjusting My Plan

As I moved forward, I found it essential to reflect on my journey regularly. I evaluated what strategies were working for me and which ones needed adjustment. Bach encourages flexibility, and I embraced the idea that my financial plan could evolve as my circumstances changed.

Conclusion: My Path to Financial Freedom

‘Start Late, Finish Rich’ has been a transformative read for me. It provided me with the tools and mindset necessary to take charge of my finances, regardless of when I started. By setting clear goals, assessing my situation, applying the strategies, and staying committed, I feel empowered to achieve financial freedom. If you’re considering this book, I encourage you to approach it with an open mind and a willingness to take action.

Author Profile

-

Wei Hsiung is a hospitality professional turned product reviewer with a background in boutique hotel management across Singapore, Kuala Lumpur, and Taipei. With a degree in Hospitality and Tourism Management, Wei developed a sharp eye for quality, comfort, and design through years of curating guest experiences and evaluating lifestyle amenities. That same attention to detail now guides every review he writes.

In 2025, Wei launched Hotel Indigo Garden to share honest, experience-based product insights. Living in Penang, Malaysia, he spends his days testing travel gear, home essentials, and everyday tech to help readers make informed choices. His reviews are guided by one simple rule — authenticity over advertising — offering readers practical advice they can genuinely trust.

Latest entries

- November 23, 2025Personal RecommendationsWhy I Switched to a 0.5 Oz Bottle Size: My Expert Experience and Insights

- November 23, 2025Personal RecommendationsDiscovering the Sweetness of 0 Calorie Maple Syrup: My Personal Journey and Expert Insights

- November 23, 2025Personal RecommendationsWhy I Switched to a 0 Gauge Amp Kit: My Personal Journey to Superior Sound Quality

- November 23, 2025Personal RecommendationsWhy Upgrading My 01 Dodge Ram 2500 Headlights Transformed My Nighttime Driving Experience